Investing in commercial real estate offers an exciting path for wealth building. Unlike residential properties, commercial real estate often provides higher returns and more opportunities. Understanding the dynamics of commercial properties can lead to significant financial growth over time. The Different Types of Commercial Properties Commercial properties come in various forms, each with distinct characteristics …

Why Commercial Properties Are the Key to Growing Your Wealth

Investing in commercial real estate offers an exciting path for wealth building. Unlike residential properties, commercial real estate often provides higher returns and more opportunities. Understanding the dynamics of commercial properties can lead to significant financial growth over time.

The Different Types of Commercial Properties

Commercial properties come in various forms, each with distinct characteristics and investment potential. This includes office buildings, retail spaces, warehouses, and multi-family units. Each type serves a specific market need and carries its own set of risks and rewards. For example, office buildings might attract long-term tenants, whereas retail spaces can fluctuate based on consumer trends.

Investors can diversify their portfolios by choosing different types of commercial properties. This variety can help mitigate risks associated with economic downturns. Having a mix of property types means that if one area suffers, others may still perform well.

Higher Income Potential

One of the main draws of commercial properties is the potential for higher rental income. Commercial leases typically span longer durations than residential leases, often ranging from three to ten years or more. This stability provides a consistent cash flow, allowing investors to plan their finances better.

Moreover, tenants in commercial properties often cover additional expenses, such as maintenance, property taxes, and insurance, through a triple net lease. This shifts some financial responsibility away from the landlord and enhances the overall profitability of the investment. When considering returns, this arrangement can significantly increase the net income generated by the property.

Appreciation and Long-Term Value

Commercial properties tend to appreciate in value over time. Market trends, community development, and economic growth can all contribute to increasing property values. As areas grow and develop, the demand for commercial space often rises, leading to higher prices.

Investors who hold onto their commercial properties long-term can benefit from significant appreciation. This growth can lead to substantial profits when it comes time to sell. Additionally, improvements made to the property can enhance its value, providing another avenue for increasing equity.

Tax Benefits

Investing in commercial real estate also offers various tax advantages. Depreciation is a key benefit, allowing property owners to deduct a portion of their property value from taxable income over several years. This can lead to substantial tax savings, improving the overall return on investment.

Furthermore, many expenses related to managing and maintaining the property can be tax-deductible. These can include maintenance costs, property management fees, and mortgage interest. Investors can maximize these benefits to enhance their overall financial position.

Financing Opportunities

Financing commercial properties can be more accessible than one might think. Many lenders are eager to invest in commercial real estate due to its higher income potential.

This appetite means investors can often find favorable loan terms with reasonable interest rates. For those looking to finance their projects, homebldr investment loans can be an excellent option to explore.

Understanding the various financing options available is crucial. Investors can choose between traditional bank loans, commercial mortgage-backed securities, and private lending. Each option offers unique advantages and challenges, so it’s wise to weigh these carefully before making decisions.

Building Equity

Equity growth is a primary driver of wealth in real estate investing. As mortgage payments are made, property equity increases. This equity can serve as a financial resource for future investments or personal needs.

Commercial properties typically require larger investments than residential ones, but they also provide higher equity growth potential. With responsible management and strategic improvements, investors can see their equity grow significantly over time.

Risk Management and Due Diligence

Investing in commercial properties is not without its risks. Economic downturns, shifts in market demand, and property management issues can negatively impact profitability. However, these risks can often be mitigated through thorough due diligence.

Conducting extensive market research and property inspections prior to purchasing is essential. Analyzing local economic trends, vacancy rates, and comparable property sales can provide valuable insights. This information allows investors to make informed decisions, ultimately reducing their exposure to risk.

The Role of Location

It’s said that location is everything in real estate, and this holds true for commercial properties. A prime location can attract high-quality tenants and lead to lower vacancy rates. Areas with strong economic growth, accessibility, and amenities tend to command higher rents.

Investors should carefully evaluate potential properties based on location. Proximity to major transportation hubs, business districts, and urban centers can significantly influence a property’s long-term success. When selecting a property, consider how location will impact demand and future growth.

Networking and Partnerships

Building a network within the commercial real estate community can be instrumental in growing wealth. Establishing relationships with other investors, brokers, and property managers can open doors to new opportunities. Networking can facilitate partnerships, leading to joint ventures that pool resources and expertise.

Collaboration can provide access to larger deals that may be unattainable individually. By working with others, investors can share risks and increase their chances of success. The power of a robust network should not be underestimated in the realm of commercial property investment.

Leveraging Technology

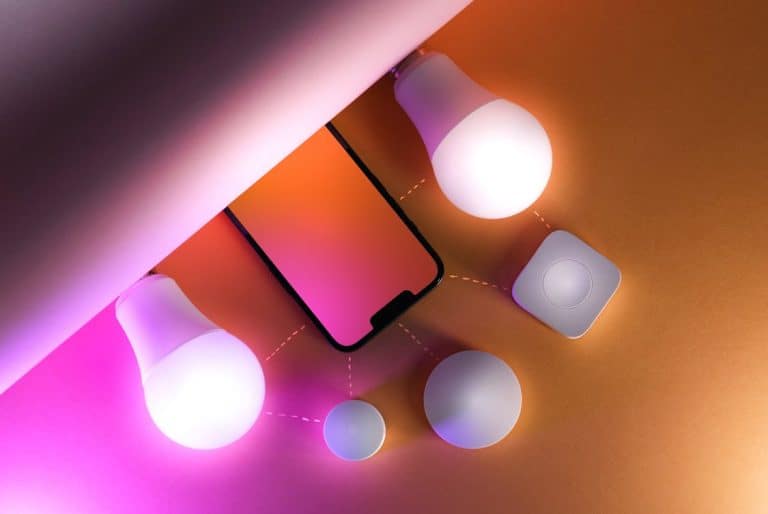

Technology plays a vital role in modern commercial real estate investing. From property management software to market analysis tools, tech can enhance decision-making and efficiency. Leveraging these resources can streamline operations and improve overall profitability.

Virtual tours and online marketing strategies can attract potential tenants more effectively. Additionally, data analytics tools can provide deeper insights into market trends, enabling smarter investment choices. Embracing technology can give investors a competitive edge.

A Focus on Sustainability

The increasing emphasis on sustainability in commercial real estate cannot be overlooked. Properties that incorporate green building practices and sustainable features often see higher demand. Tenants are increasingly seeking environmentally friendly options, which can lead to greater tenant retention and higher rental rates.

Investing in energy-efficient upgrades can not only reduce operational costs but can also significantly enhance property appeal. Sustainability is more than a trend; it’s becoming a staple in the commercial real estate landscape, influencing investment decisions today.

Understanding Tenant Needs

Successful commercial property investing hinges on understanding tenant requirements. Different types of businesses have unique needs that influence their choice of location and space. For instance, retailers may prioritize foot traffic, while tech companies might seek modern office spaces with ample infrastructure.

Conducting regular communication with tenants can enhance satisfaction and retention. Knowing their expectations allows property owners to make necessary adjustments, keeping tenants happy and minimizing turnover. Happy tenants often result in a stable income for property owners.

The Power of Professional Management

Effective property management can significantly impact the success of a commercial real estate investment. Professional managers can oversee daily operations, handle tenant relations, and implement marketing strategies. Their expertise can free up the investor’s time and enhance the property’s performance.

Investors should weigh the costs and benefits of hiring property management services. While it may incur additional expenses, the potential increase in income and reduced headaches can make it worthwhile. Investing in professional management can be a game-changing decision.

Market Research and Continuous Learning

An essential aspect of growing wealth through commercial properties is staying informed. The commercial real estate market is constantly changing, and trends can shift rapidly. Engaging in ongoing market research can help investors identify new opportunities and avoid potential pitfalls.

Keeping up with industry news, attending seminars, and networking with other professionals can expand knowledge and insight. Continuous learning fosters agility in decision-making, allowing investors to adapt to market fluctuations effectively.